Content

- Calculate Your Paycheck in These Other States

- California Tax Guide: CA State Tax Information & Rates

- IRS Free File & How to Get Free Tax Preparation or Free Tax-Filing Help in 2023

- California State Income Tax Credits

- California and Federal Income Tax Brackets

- California Tax Rates, Brackets, and Standard Deductions

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

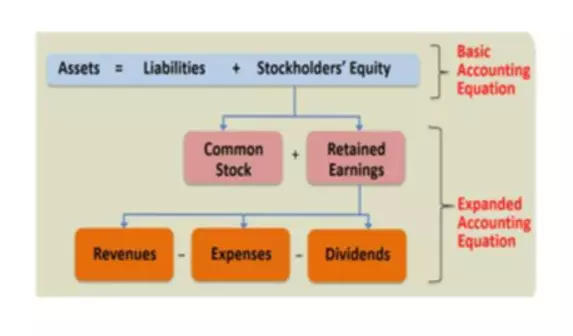

A key aspect to tax equity is how a tax — or a tax system as a whole — impacts households across income levels. One way to measure this is by comparing effective tax rates —meaning the share of one’s income paid in a tax — of people in different income groups. A tax is considered progressive when households with higher incomes have higher effective tax rates than those with lower incomes. With regressive taxes, people with lower incomes have higher effective tax rates than people with higher incomes.

Calculate Your Paycheck in These Other States

Securities and Exchange Commission as an investment adviser. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any user’s account by an Adviser or provide advice regarding specific investments. If you are looking to refinance or purchase a property in California using a mortgage, check out our guide to mortgage rates and getting a mortgage in the Golden State. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes.

- Input the total of your itemized deductions, such as mortgage interest, charitable contributions, medical and dental expenses, and state taxes.

- While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

- Overall, the state ranks 48th in the Tax Foundation’s State Business Tax Climate Index Rating.

- This influences which products we write about and where and how the product appears on a page.

Tax types and rates vary by the type of business you own (e.g. LLC, S-Corp). Tax codes change often, so it’s best to refer to the State of California Income Tax filing requirements by business ownership type to get the most up-to-date details. An alternative minimum tax is intended to ensure wealthy taxpayers do not use loopholes to avoid paying taxes. Taxes in California are among the highest in the United States and are imposed by the state and by local governments. The Realtors say that could help with the housing shortage by encouraging more seniors to move to smaller homes or closer to their families.

California Tax Guide: CA State Tax Information & Rates

This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. We believe everyone should be able to make financial decisions with confidence.

The what is california income tax ratees collected are used to fund social security benefits. California’s corporate income tax applies to corporations and is based on income earned in California. Income from “pass-through” entities like S-corporations, limited liability companies , partnerships, and sole proprietorships is subject to the state’s tax on personal income. Other relatively high-tax states like California and New York aren’t in the top 10 because they have more gradual tax rate increases for those earning less than $75,000. Californians only pay a marginal tax rate of 4% on earnings between $23,943 and 37,788. In New York, earnings between $13,901 and $80,650 incur a 5.5% marginal tax.

IRS Free File & How to Get Free Tax Preparation or Free Tax-Filing Help in 2023

It is imposed on insurance premiums and paid by insurance companies, although in practice it may lead to higher rates for consumers. – We regularly check for any updates to the latest tax rates and regulations. California assesses a 7.25 percent tax on the purchase of tangible personal property, such as clothing and furniture, and localities charge an average of 1.43 percent on top of that. DE, HI and VT do not support part-year/nonresident individual forms. Most state programs available in January; software release dates vary by state.

Is 100k salary a lot in California?

At $100,000 a year, an individual or small family can likely live in most locations. In fact, $100,000 is higher than the annual median income ($65,290) of America's most expensive city, Los Angeles.

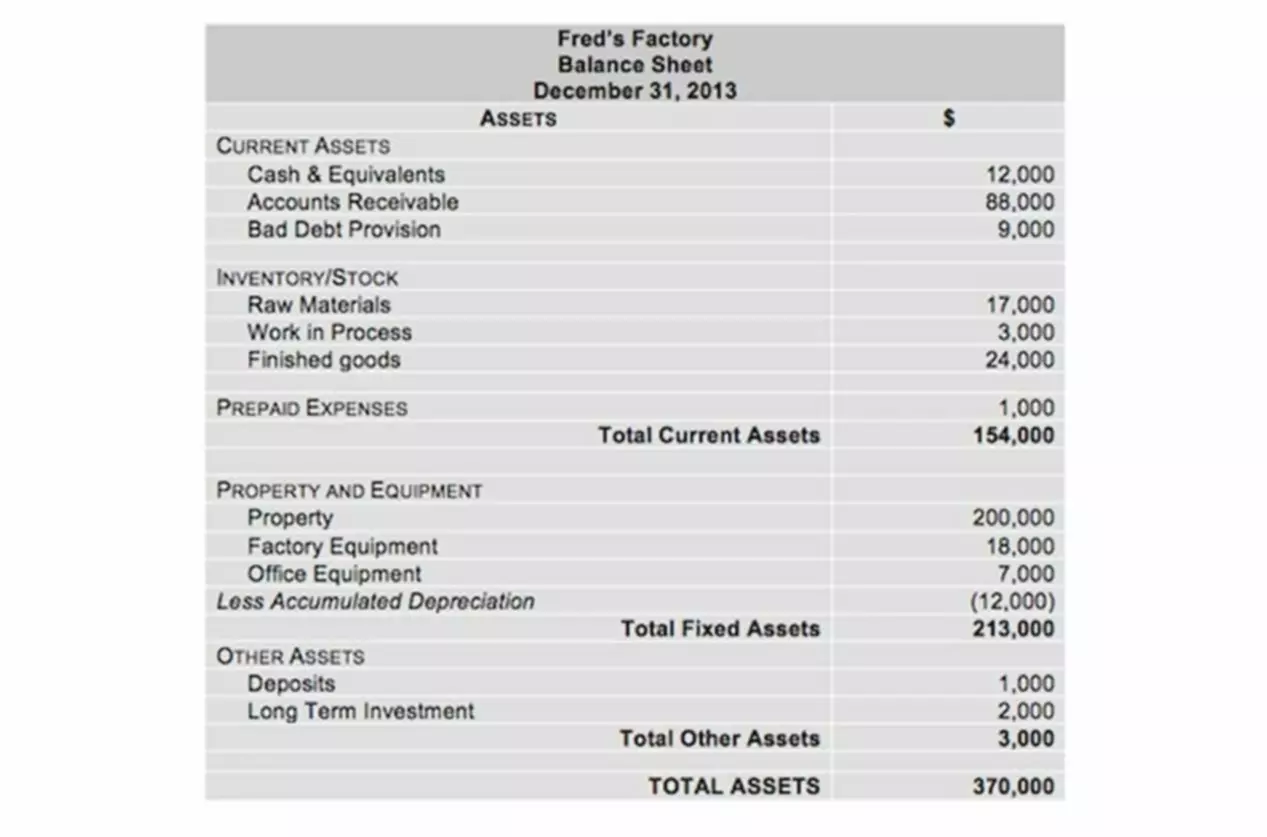

The table below further demonstrates tax rates for Californians. Although California exempts social security benefits from state income taxes, other retirement incomes are considered taxable incomes. If you have pension income, IRA withdrawals, 401 withdrawals, and other forms of retirement income, you will pay state income taxes at your tax bracket. Depending on the income you have, the state income tax rate ranges from 1% to 13.3%.